The intersection of technology and manufacturing makes sense on paper, but adoption is slow. Here’s why.

Unlike the , which is largely still a collection of connected devices that don’t always play well together, the Industrial Internet of Things (IIoT) already is in heavy use and growing across a number of markets well outside of the usual markets associated with semiconductors.

A Morgan Stanley “blue paper” report issued last year identified 14 separate industries where technology could reduce inefficiencies or grow revenues, or both, ranging from smart lighting in residential applications to improvements in supermarkets to food monitoring of mining equipment and autonomous mining. There were the usual suspects, ranging from supply chain management and process monitoring in factory automation, but there were a number of new approaches that include wearables in business, patient monitoring in pharmaceuticals, and transportation equipment monitoring.

As with all IoT derivatives, market projections vary greatly. Where they do exist, they involve some very large numbers. Morgan Stanley said with just 50% penetration, the IoT could save $500 billion due to factory automation. SAP recently put the worldwide IoT opportunity for discrete manufacturing industries at $746 billion by 2018.

The base technology scheme for the IoT and the IIoT are roughly the same—semiconductors, sensors and memory, connected through some communications technologies and layers to cloud and edge processing. Still, it’s much harder to make generalizations about the IIoT for several reasons:

1. IIoT technology is competitive. While companies have been installing sensors, communications infrastructure and processors—MCUs, APUs, CPUs—for years, they don’t like to talk about it for competitive reasons. As a result, most of the data collected for the IIoT is anecdotal, from the top down, versus the IoT, where unit shipments for devices such as Apple’s SmartWatch or the FitBit are readily available.

2. Technology is being implemented piecemeal as it makes sense. New valves can predict the flow, temperature and pressure of liquids moving through pipes, for example, and they can communicate any changes in real time. Those valves can save money, but they weren’t widely available a couple years ago.

3. The IIoT is not a homogeneous market or application of technology. There are so many variations within industries, across industries, with lines blurring even between consumer and industry with wearable devices that can be used for monitoring factory automation, that it’s difficult to draw real information even where it is available.

Still, there are some important shifts that define the IIoT and separate it from how technology was used in the past by manufacturers.

“A lot of manufacturers have been working on connectivity for years,” said Warren Kurisu, director of product management for runtime solutions in Mentor Graphics’ Embedded Systems Division “But with the Industrial Internet of Things, a number of things are changing. One is down at the device level. The intelligence that can be built into these devices in terms of their ability to gather data and to process that data and make some decisions lower down into the devices is new. What you do with that data is to feed it up into the enterprise. That’s new, too. What’s also new is the use of the Internet to enable remote access to this data for decision-making and process much more accessible. So the core of the Industrial Internet of Things isn’t new, but it is new on the cloud and at the device level.”

He noted that manufacturers are now looking to extend that data into the supply chain, as well.

The push for standardization

Across Europe there has been a concerted effort to add some structure to the IIoT, particularly on the manufacturing side. Known collectively as Industry 4.0 or smart manufacturing, the concept has been the subject of much discussion inside of companies because the ROI is measurable and predictable.

“This holds many of the same elements we have tried to overcome in the consumer market, which is to make interactions between electronics more intuitive,” said Paul Hubmer, general manager for NFC infrastructure and consumer markets at NXP. “There is a lot of complexity across the production line that could be simplified.”

Hubmer said that what has kept some companies from jumping in is that it can’t be done piecemeal. “You need to make it an integral part of the supply chain. A cheap and simple trial will not get you anywhere. You need to tune the process, and to do that takes an infrastructure investment and you need to adopt a background system. The business case makes sense and it’s easy to calculate an ROI. But there is no ‘Plan B.'”

However, that has made this approach particularly popular in places such as China, where new factories are commonplace. It also has won support in the automotive industry, where no two cars are the same and customization can be controlled by electronics.

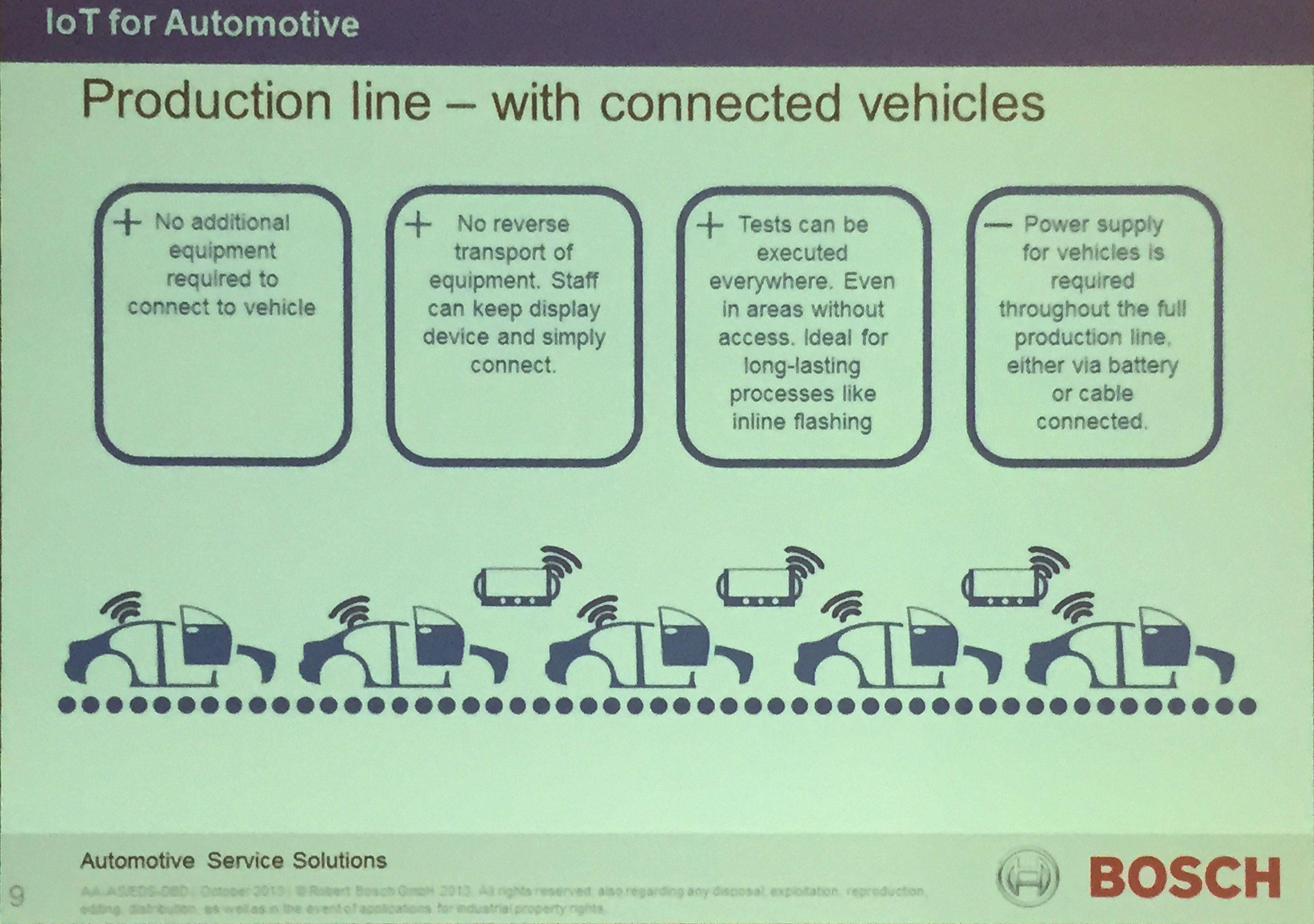

“The savings are significant,” said Frank Schirrmeister, group director for product marketing of the System Development Suite at Cadence. “If you use a connected car just for manufacturing as you move from station to station, it gives you a way to optimize the production process. Once you figure out a level of commonality, then the savings can be huge. But there does need to be some level of commonality of what data you can collect, and that has not been figured out yet.”

Fig. 2: Presentation at DATE by Jurgen Horning, director of OE diagnostics solution design group at Bosch. Photo by Frank Schirrmeister.

He said that predicting when parts will fail in a factory, or even in a connected device, can have huge savings for manufacturers, as well.

This has made it particularly attractive in the chemicals industry, where downtime can be prevented using connected sensors. “With the Internet of Things, everyone is looking for ROI,” said Tony Massimini, chief of technology at Semico Research. “Can you justify the investment? With consumers, it’s hard to see the payoff. Companies are still trying to figure out how to sell services to them where they download the latest security and updates. But with a factory you can see an immediate payoff.”

He said the big market for chips will be on the consumer side, but the ROI will be higher for the IIoT. Conversely, it will be much harder to calculate the equation on the IIoT because it is so fragmented and companies are using unique implementations of smart technology, while in the consumer market one size generally fits all even with widely divergent use cases.

Changing the metrics

Perhaps the hardest thing to envision with the IIoT is what the big picture is and how to interpret the metrics. Efficiency has been measured since the days when Henry Ford perfected the assembly line as more pieces per hour, and much of the IIoT still utilizes that approach. But those are rather one-sided measurements, though, and while they were the best available for their time they are not the only measure of efficiency.

The push toward just-in-time manufacturing at the turn of the Millennium was a first step in recognizing the need for real-time information in industry, matching customer demand to production and placing controls across the entire supply chain to avoid inventory gluts. The next phase will be to deploy more real-time information in more places, including some that are predictive.

“A smart production line can enable industry to gain efficiencies between two fab lines,” said NXP’s Hubmer. “It’s a measurement less about the number of pieces per hour than tools per run, so you can decrease the amount of wrong tooling.”

How those metrics get implemented, whether it’s piecemeal or all at once remains to be seen. But the bottom line is that the IIoT will continue growing because there is documented payback for money invested. How much it will grow, and how far-reaching the changes may depend on adoption within industries by competitors, a deeper understanding of business processes and efficiencies, and business factors such as depreciation, investment capabilities, and more standardized approaches to implementing efficiencies.

Leave a Reply