Materials supply chain still bumpy and consumer buying has peaked for now, but growth continues.

The market for chips will continue to grow over the next few years, but not as quickly as over the past couple years when the work-at-home market drove up demand for everything from laptops and TVs to home video equipment.

Economists painted a mixed picture for the semiconductor industry at this week’s SEMI Industry Strategy Symposium, projecting continue growth in all major markets, but tempered by people returning to work, saturated demand for some products, and continued shortages that will weigh down results.

U.S. economy

Inflation continues to concern economists, although most expect it to diminish over the next couple years. “Anyone who has gone to the grocery store or tried to buy a car in the last year knows that we have seen some of the highest inflation in the last 40 years,” said Tim Mahedy, senior economist at KPMG. “We’ve estimated that 75% of the current workforce has never been in an inflationary environment like this, with wage growth at 5.5% to 6%.”

The good news, Mahedy said, is that inflation is likely to drop significantly in 2023, particularly as rate hikes in 2022 and 2023 increase the cost of borrowing capital and the pandemic slows or ends. “High inflation does erode people’s wallets, so you can buy less things,” he said. “We have seen some measures of consumer confidence come down. But not all of them have come down, which is an important point, because that’s when you start to get worried about the economy.”

Mahedy predicts a slowdown in consumer spending, but notes there is no indication that a contraction is coming because people still have jobs and money to spend. The bigger concern is on the employment side, because the labor force appears to be shrinking.

“There’s something going on here that isn’t around COVID,” he said. “Because of where our society is, because of where birth rates are, because of the immigration issue…this picture is likely to remain true for a while. If you are planning or hoping there would be a strong rebound in employment, a strong rebound for labor post-COVID, I would urge you to think differently about that. That’s just the math.”

Chip industry outlook

Drilling down one level to the chip industry, supply chain disruptions are expected to continue for at least the next couple years. The positive news is there are enough market segments and sufficient demand within those segments to weather some of the larger economic bumps. Between 2019 and 2021, the chip industry grew an estimated 36%, according to Michael Yang, senior director for semiconductors at Omdia.

“Every single segment group, every single company in the semiconductor industry benefited,” said Yang. “Among the list of top 10 companies, 9 companies had double-digit revenue growth, and some had 30% revenue growth year over year. Out of the 247 companies that we track, 145 of them had more than 20% revenue increases. It was a fantastic year for two primary reasons. First, revenue is a function of demand and ASP, and we saw demand grow significantly. Consumer behavior changed quite a bit during the pandemic and caused a lot of shortages for various semiconductor components, and ASPs rose.”

Between 2019 and 2021, the chip industry grew 46%, which is a record. Since then, demand for smartphones, PCs and large-screen TVs has declined, but Yang said the overall industry remains strong, in part because chips are being used today across so many different industries. He noted that in California, for example, all new lawnmowers sold must be electric rather than gasoline-powered, which require chips. The same is true for new automotive designs, which are increasingly electrified.

Materials and equipment

Still, the industry is swimming against the current when it comes to raw materials. Inna Skvortsova, a SEMI analyst, pointed to a variety of areas that will be affected by capacity and materials shortages.

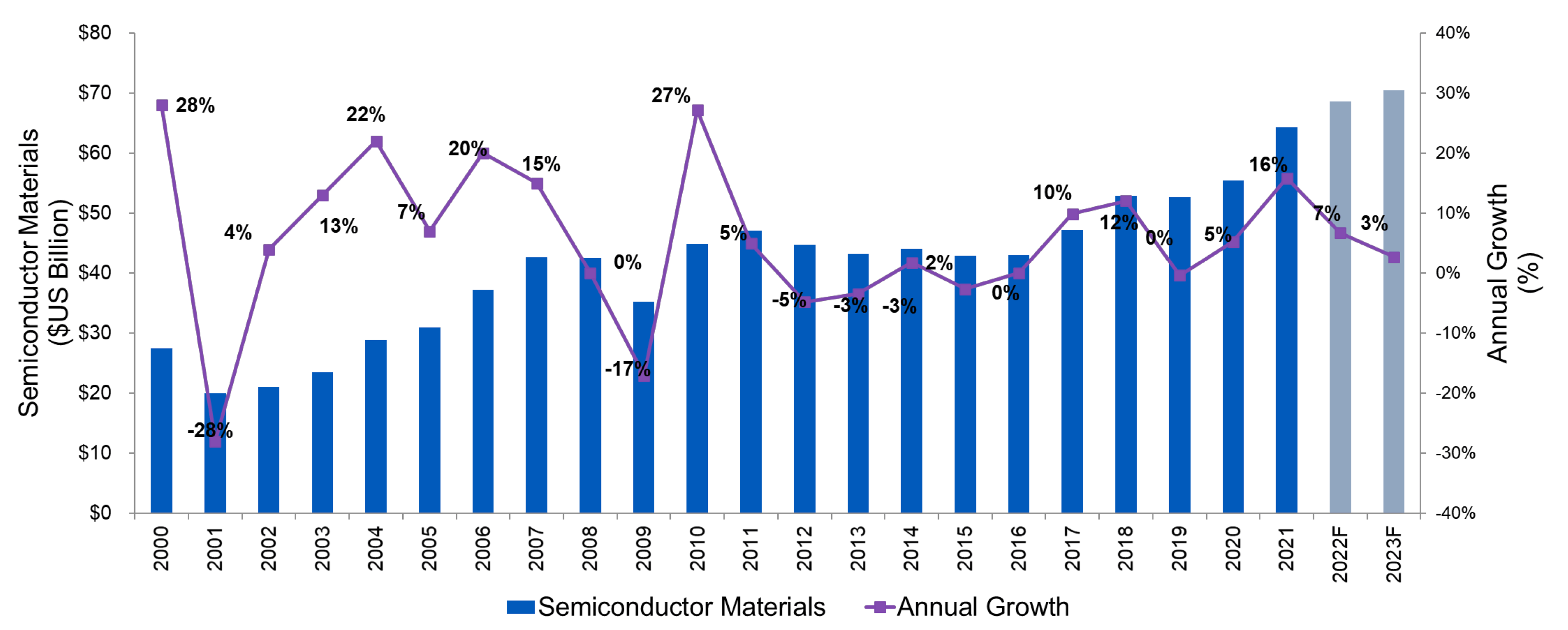

Fig. 1: Semiconductor materials market trends. Source: SEMI/ISS

“One of the ironies is that the semiconductor shortage is now hitting chipmakers and leading to longer lead times for the equipment needed to manufacture chips,” Skvortsova said. “One chip allocated to an equipment maker may result in 100,000 chips per year manufactured for other markets.”

Despite that shortage, she said semiconductor sales will pass the $600 billion this year, coming off the 26% year-over-year growth in 2021. Materials sales are tracking higher, despite limited capacity. And the trend lines across all manufacturing segments continues to increase, despite the unrealized growth due to limited supplies of everything from silicon wafers to photoresists and packaging materials.

On the fab capacity side, Skvortsova said there were 75 ongoing fab construction projects in 2022, with 62 planned for 2023. There were 28 new volume fabs that started construction in 2022, including 23 300mm fabs and 5 fabs for 200mm and below. It takes several years for fabs to be completed.

In terms of capacity:

“The industry outlook is quite strong and optimistic,” Skvortsova said. “In 2022, semiconductors are expected to show very strong and healthy growth — at least high single digits. The semiconductor materials and equipment markets are also projected to grow beyond the results of the previous year, and all that is on top of record high results. However, all of this potential is not without some uncertainty. Supply chain challenges persist. And inflation caused by increased costs of raw materials and transportation may adversely affect these goals.”

What’s apparent from these presentations and others, though, is that economist and market analysts continue to be upbeat for the chip industry for the next few years. The exact numbers will vary, and economists agree that nothing is ever for certain. But at this point, the fever charts are still pointing in the right direction, even if it’s not the COVID-induced spikes of 2020 and 2021.

Fig. 2: 300mm capacity by region. Source: SEMI/ISS

Fig. 3: 200mm and below fab capacity, by region. Source: SEMI/ISS

thanks for the facts. even if pandemic ended the product market keeps expanding. computers, automotive, higher efficiency of energy usage and production, robotics , medical process usage. the list goes on and lest I forget there is food production , elderly care.