Growth continues to surge, but definitions, management and security issues remain problematic.

The Internet of Things represents many things to many people, and many of them are not good.

For some it is either a laughingstock or a punching bag. For IT, it is a subject of derision because securing all connected devices at the edge is a nightmare. But in all cases, the general consensus is that the IoT has failed to live up to expectations and a level of hype not seen since the dot-com days. While more devices are being connected to the Internet, concerns about security and questions about the value of remotely programming a home appliance have never been put to rest. Even the definitions of what the IoT actually encompasses, or what it ultimately will be, remain vague.

“The Internet of Things continues to evolve,” says Jenalea Howell, director of IoT & Smart Cities for IHS Technology. “IoT is a conceptual framework, not a market.”

IHS estimates there are 27 billion “connectable devices” out in the world now, with 9.5 billion being shipped this year. By “connectable devices,” the market research firm takes in connected devices and devices that are not actively connected to the Internet, such as a Fitbit stowed away in a drawer.

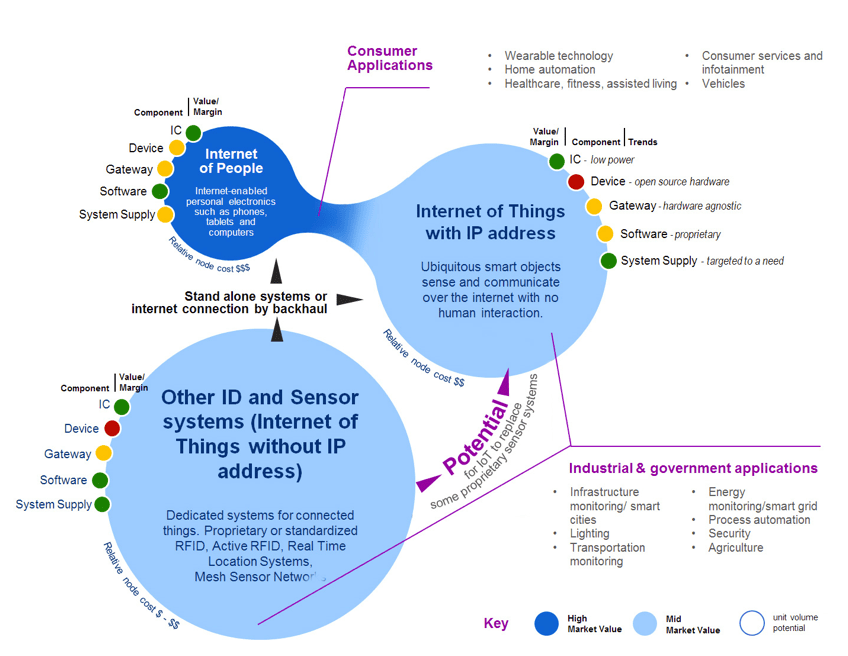

Fig. 1: The IoT landscape. Source: IDTechEx

Commercial and industrial electronics are one of the bright spots in this market, because there is measurable return on investment by adding wired or wireless sensors into an industrial operation. That market will enjoy a compound annual growth rate of about 20% through 2030, IHS forecasts, while consumer electronics will see only a CAGR of 12.5% over that period. Commercial and industrial devices will overtake worldwide shipments of communications devices (mobile phones, smartphones, etc.) in 2025, the firm predicts.

IHS sees a worldwide installed base of more than 120 billion IoT devices in 2030. Commercial and industrial devices will make up the largest percentage of that base, followed by communications, consumer, automotive and transportation, computers, and medical electronics.

Gartner earlier this year estimated the installed base of IoT devices would reach 8.38 billion this year, a 31% gain from 6.38 billion units in 2016. Nearly two-thirds of 2017’s installed base will be consumer devices, at 5.24 billion units. Greater China, North America, and Western Europe will account for two-thirds of this year’s installed base, it said.

Gartner calls for the global installed base to hit 11.2 billion devices in 2018 and 20.4 billion devices in 2020. Businesses will outspend consumers in 2017 and 2018, while consumers will narrowly outspend businesses for IoT hardware in 2020, at nearly $1.5 trillion, compared with $1.43 trillion for business applications, according to the market research firm.

Howell of IHS says there are four main drivers for IoT adoption – innovation and competitiveness, business models, standardization and security, and wireless technology innovation.

“We get this all the time. The main question is: ‘IoT’s been happening for years. What’s different?’ Today, the solutions are different. They’re more sophisticated,” she says. “Each of these are fundamentally different. Whereas as before we were talking about APIs for security, now we’re talking about blockchain platforms. Business models – companies are really seen approaching this differently, using the cloud or the ecosystem approach now.”

The decreasing cost of semiconductors enables the connectivity in devices with low average selling prices, the industry analyst notes. The average IoT connectivity growth across all technologies will be moderate, at 12%.

In 2016, 5.3 million chips went into IoT communications, IHS estimates. Consumer electronics consumed 2.9 million chips, while 2.3 million ICs were used in commercial and industrial electronics. Computers commanded 800,000 chips and medical equipment accounted for 600,000 chips, while automotive and transportation represented 500,000 ICs.

When it comes to IoT for the sensor markets, IHS is conservatively forecasting there will be tens of billions of sensors shipped, not trillions. Industrial and commercial applications will represent most of the IoT sensors market.

The most popular use cases are smart buildings and smart lighting, Industrial IoT and smart manufacturing, and smart home and voice control, Howell says. Security and smart-home services are the prime drivers for the smart home.

In time, IoT services will produce more revenue than IoT hardware, according to IHS. IBM, Microsoft, and SAP currently lead in IoT platforms. ABB, General Electric, Schneider, and Siemens are the top vendors in Industrial IoT platforms, a $7 billion to $10 billion market. Agura, Azima, and Senseye are heading up specialized sensor-based predictive analysis.

MEMS microphones have been a consistent market since those devices were used in the iPhone and other smartphones. The Amazon Echo and other smart speakers are now driving the sales of MEMS microphones, according to Howell.

Security, definitions, and other issues

Despite what appear to be significant growth rates, there is widespread agreement those numbers could be higher. Security remains a drag on the market because many consumers and businesses are reluctant to connect everything without better security.

“Cybersecurity is a mess,” said Arm CEO Simon Segars. “As we go into this world of IoT, the threats just explode exponentially. We can do something about it, but if only if we choose to. And it is our choice.”

Even defining the IoT to make apples-to-apples comparisons about growth and potential troublespots is difficult. Stacey Higginbotham of SKT Labs, a journalist who frequently writes about the IoT, gave a keynote at Arm TechCon entitled, “Why Is IoT So Hard?”

“The Internet of Things – I don’t actually think it exists,” said Higginbotham, who said a more apt description is that it is an enabling technology. “It’s a bunch of things that have come together over the last few decades. We’re looking at things like the cost of storage. It is obviously getting cheaper and cheaper – thank you, Moore’s Law. The cost of compute, same thing. Broadband costs – it’s obviously not moving as fast as the cost of computing. But it’s definitely going down. Meanwhile, speeds are getting faster and they’re going mobile. And the cost of sensors – getting cheaper all the time. When you combine all of these things together, we get the ability to instrument the world. We can stick sensors on anything, pull that data, and start analyzing it for insights. And this is a very profound shift that we’re entering into. I don’t know if we’re ready for it.”

What’s not clear is who gets to decide what matters, who enforces things, and whether there are reputable studies to back up all of this, she said. “None of this is going to be easy. Technology revolutions do not happen overnight. They take decades.”

Bright spot: Location data

One of the recent trends in the IoT is to pull data from a variety of sources and use it commercially. Google’s Waze app is one of the best-known examples of this real-time mapping technology, based up traffic patterns gathered from connected smartphones, and it serves up time-sensitive, location-specific advertisements along the way. But this technology also is used by everything from robotic vacuum cleaners to call centers.

Fig. 2: Google’s Waze. Source: Google

“Location information, location data, the ability to locate things, plays into a lot of different use cases,” said Brian Salisbury, vice president of product management at Comtech Telecommunications. “We think that knowing where data was captured, knowing where events are happening, knowing where people are, and the relevant position of those things and people, versus other things, can add a lot of value as the IoT industry evolves. And it’s important to start paying attention to location as a design element in solutions early on, because the data you create with your IoT solutions now, if it’s not tagged with location, is going to be less useful in the future as part of looking at it from an analytics perspective.”

Companies playing in this segment see a big opportunity, although it’s still unclear which companies ultimately will win big here.

“We’re focused on mapping everything indoors,” said Ankit Agarwal, founder and CEO of Micello. “So, think maps of airports, shopping malls, museums, convention centers, corporate campuses, nuclear power plants, every indoor commercial space. We operate a content syndication platform. On one hand, we work with buildings to map them out, and on the other hand we work with incredible technology partners including Comtech, who use the data in their products. Indoor maps can be used for public safety, facility management, analytics, wayfinding, indoor positioning, all kinds of things. But a growing category of our partners are in IoT. And the way we’ve been thinking about the value and the role of indoor maps for IoT in the last year – it’s, really, a map is a canvas. A map is a visual container for all the information, all the sensors, that are getting deployed in any commercial building. When I talk to the new furniture makers, every chair is going to have a sensor built in, every fire extinguisher will come with a sensor built in. Buildings are deploying thousands of sensors of all types, and shapes, and sizes throughout their built environment. These sensors generate tons of data, and a map is a visual interface to make sense of all of that information. As every device gets a heartbeat, you can visualize it on a map. Connecting the location of the sensor to a location happens when you have a map. Our role is in providing that location data to enable the analytics, enable the insights, enable the developer ecosystem to build these kinds of applications specifically around the indoor environments. I love maps, of course, I love locations.”

Conclusion

The IoT is still evolving, and as it evolves the initial perceptions about what would work and how it would work are changing. While there are still big issues to solve, such as security and potentially who manages which pieces, it’s hard to argue with double-digit growth projections and the creation of entirely new markets that never existed before.

What exactly the IoT will look like 5 or 10 years from now isn’t clear. But it’s almost certain to remain an important growth engine for semiconductors and related technology, particularly on the industrial side where there is measurable return on investment and an obvious benefit for companies.

Great article Jeff – I like to think of the IT ecosystem as doing 4 things to information; process, store, transmit and transduce. At Vesper we are focused on information transducers but plan to play in the integrated sensor node market as it evolves and grows.