Analysis: What’s driving the deal, and what to watch for.

Nvidia inked a deal with Softbank to buy Arm for $40 billion, combining the No. 1 AI/ML GPU maker with the No. 1 processor IP company.

Assuming the deal wins regulatory approval, the combination of these two companies will create a powerhouse in the AI/ML world. Nvidia’s GPUs are the go-to platform for training algorithms, while Arm has a broad portfolio of AI/ML processor cores. Arm also has the leading processor architecture for smart phones, and its emphasis on low power has made it the top company in the IoT and edge computing markets — and an acquisition target for Nvidia.

While this may seem like a mismatched deal on the surface, dig a little deeper and it begins to make sense. To begin with, Nvidia has been looking for a way to expand beyond its base of training algorithms. The problem it has encountered is that GPU architectures are not especially power-efficient. They’re cheap, well-understood, and easily parallelized on a massive scale with relative ease, and nearly everyone in this space knows how to program them. But even in a data center, which is where nearly all AI/ML/DL training is done, power is expensive. It costs money to power and cool racks of servers, and data centers measure that with great accuracy.

For Nvidia to continue to dominate that space, it needs a heterogeneous architecture that combines the efficiency of a CPU to more tightly manage its GPUs. The company gave some hints it was looking in this direction as early as 2018, when it showed off its architecture for shared memory using a CPU as a controller. As part of the current deal, Nvidia said it will build a supercomputer powered by Arm CPUs.

Fig. 1: Nvidia’s NVLINK-switching chip, circa 2018. Source: Nvidia/Hot Chips 30

Arm, meanwhile, has been developing its own line of Mali GPUs, which have gained traction in devices such as cameras, but not in the cloud where Nvidia’s business has exploded over the past four years. Arm’s penetration into the server world is growing, but not at the expense of companies like Intel, AMD or IBM. And with companies such as Google, Amazon, Alibaba and Baidu now developing their own chips, that market opportunity isn’t as wide open as it appeared several years ago.

Arm’s primary base is in the IoT and the edge, and it has been very successful there. Its focus on low power allowed it to shut out Intel from the mobile phone market, and from there it has been gaining ground in a slew of vertical markets ranging from medical devices to Apple computers. But as more intelligence is added to the edge, the next big challenge is to be able to radically improve performance and further reduce power, and the only way to make that happen is to more tightly customize the algorithms to the hardware, and vice versa.

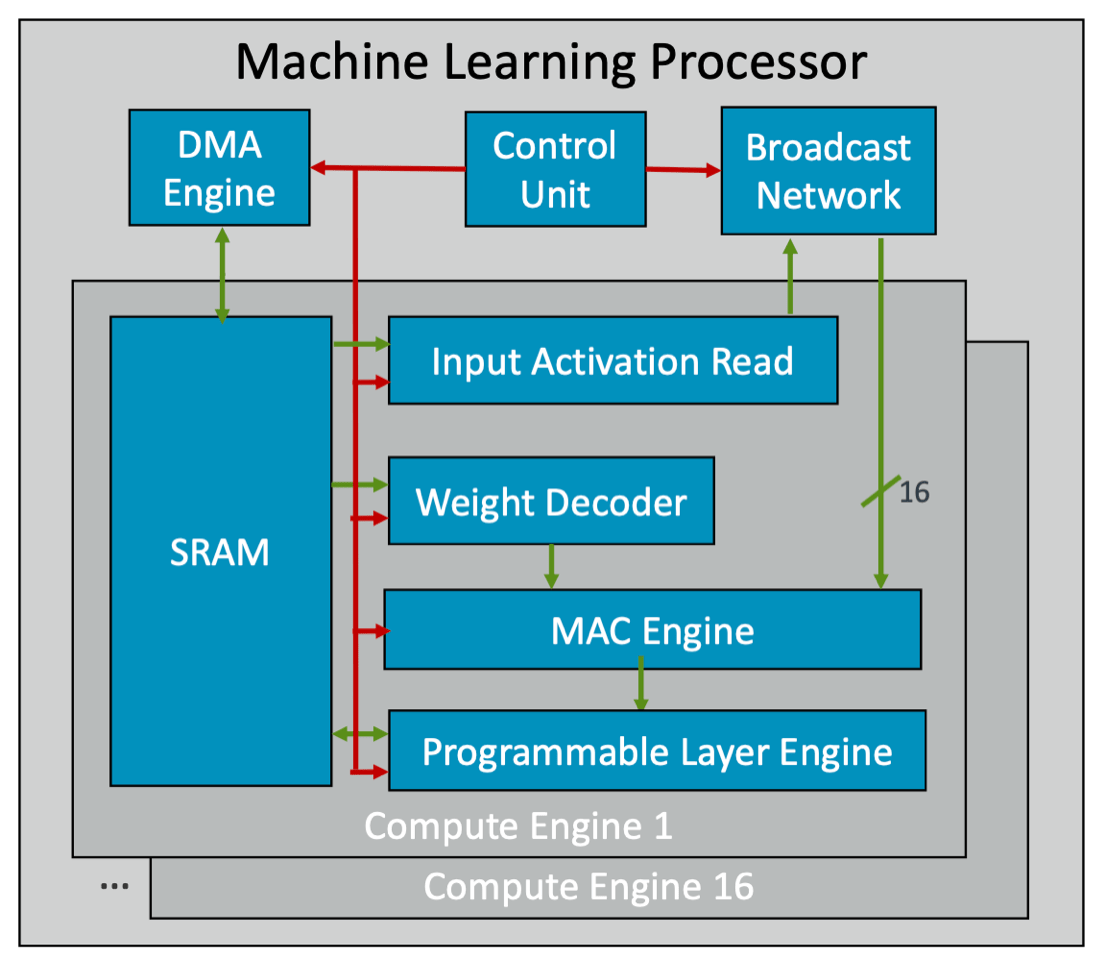

Fig. 2: Arm’s first ML processor architecture. Source: Arm/Hot Chips 30

While it’s uncertain if either Arm or Nvidia wants to take on that challenge, they certainly can develop an open platform to support customized accelerators. So rather than focus on the customized niche markets, they can target the platform that enables those niche markets. That’s an interesting strategy if it works, and one that could provide broad growth potential for the combined company.

Risks

However, the deal also raises some questions about how the marketplace will react. The ongoing trade war has made it difficult for both companies to deal with China, which today is one of the largest markets for semiconductors. While the geopolitical tensions may soften, depending upon which way the U.S. presidential election goes, China is building up its own infrastructure and betting heavily on RISC-V, an open instruction set architecture that is growing rapidly.

Arm currently is owned by Softbank, a Japanese company, but a fair amount of its R&D is based in the United States. As such, it has seen its business with Huawei, the biggest mobile phone company in China, significantly constrained. The RISC-V Foundation moved its headquarters to Switzerland to avoid such restrictions. Depending upon how the market perceives the Nvidia-Arm combination, RISC-V could continue to pick up additional market share.

In addition, Arm has emphasized from the start that its ecosystem was critical, and that it would not compete with its partners. How the Nvidia-Arm combination is perceived by those partners remains to be seen. In announcing the deal, Nvidia said it will continue Arm’s open-licensing model and customer neutrality approach, while also expanding Arm’s licensing portfolio with Nvidia technology.

Softbank, meanwhile, seems to have emerged once again on solid footing. The company overspent on its WeWork investment, building up a massive infrastructure on the assumption that companies would utilize a pre-wired office infrastructure on an as-needed basis. That business plan turned out to be overly optimistic, and it was compounded in 2020 by COVID-19, which forced many employees to work from home rather than in offices.

The sale of Arm will provide Softbank a much-needed cash infusion, but it also will cost Softbank a strategic development avenue for gaining access and insights into new markets.

Details

The companies said the deal will close in September of next year. Nvidia will pay Softbank $21.5 billion in Nvidia stock and $12 billion in cash. $2 billion of that is payable at signing.

Softbank also can receive up to $5 billion in cash or stock, subject to Arm’s financial performance targets. Nvidia also will issue $1.5 billion in equity to Arm employees.

Softbank’s stake in the new company is expected to be less than 10%, according to the announcement.

I love it!!

Good analysis !!!