Aluminum nitride, diamond semiconductors, gallium oxide and vertical GaN are all being readied, each with its own pros and cons.

After years in R&D, several vendors are moving closer to shipping power semiconductors and other products based on next-generation wide-bandgap technologies.

These devices leverage the properties of new materials, such as aluminum nitride, diamond, and gallium oxide, and they are also utilized in different structures, such as vertical gallium-nitride power devices. But while many of these technologies possess properties that exceed today’s power semiconductor devices, they also will face challenges in moving from the lab to the fab.

Power semiconductors in general are specialized transistors, which operate as a switch in high-voltage applications such as automotive, power supplies, solar, and trains. The devices allow the electricity to flow in the “on” state, and stop it in the “off” state. They boost the efficiencies and minimize the energy losses in systems.

For years, the power semiconductor market has been dominated by devices using traditional silicon materials. Silicon-based power devices are mature and inexpensive, but they also are reaching their theoretical limits.

That’s why there is a keen interest in devices using wide-bandgap materials, which can exceed the performance of today’s silicon-based devices. For years, vendors have been shipping power semi devices based on two wide-bandgap technologies—gallium nitride (GaN) and silicon carbide (SiC). Power devices using GaN and SiC materials are faster and more efficient than silicon-based devices.

Several vendors have been working on devices in R&D using next-generation wide-bandgap technologies. These materials, such as aluminum nitride, diamond and gallium oxide, all possess larger bandgap energies than GaN and SiC, meaning they can withstand higher voltages in systems.

Today, some vendors are shipping specialized LEDs using aluminum nitride. Others plan to ship the first wave of power devices built around the newer materials in 2022, but there are some challenges. All of these technologies have various drawbacks and manufacturing issues. And even if they make it into production, these devices won’t displace today’s power semis, whether that’s silicon, GaN or SiC.

“They offer incredibly high performance, but are very limited in terms of wafer size,” said David Haynes, managing director of strategic marketing at Lam Research. “They have been largely of more academic than commercial interest, but that is changing as the technology advances. But the small substrate size and lack of compatibility with mainstream semiconductor fabrication technology means that they will only likely be adopted in low-volume production of extremely high-performance devices, particularly demanding applications such as smart grid infrastructure, renewable energy and rail.”

Still, there is a wave of activity here, including:

| Material | Band gap (eV) |

|---|---|

| Silicon | 1.1 eV |

| SiC | 3.2 eV |

| GaO | 4.8-4.9 eV |

| GaN | 3.4 eV |

| Diamond | 5.5 eV |

| AIN | 6.1 eV |

Fig. 1: Different material and gaps. Source: Company reports/Semiconductor Engineering

What are power semis?

Power semiconductors are used in power electronics to control and convert electrical power in systems. They can be found in nearly every system, such as cars, cell phones, power supplies, solar inverters, trains, wind turbines and others.

There are different types of power semis, and each one is denoted by a numerical figure with a “V” or voltage. The “V” is the maximum allowable operating voltage in a device.

Today’s power semiconductor market is dominated by silicon-based devices, which include power MOSFETs, super-junction power MOSFETs, and insulated-gate bipolar transistors (IGBTs).

Power MOSFETs are used in lower-voltage, 10- to 500-volt applications, such as adapters and power supplies. Super-junction power MOSFETs are used in 500- to 900-volt applications. Meanwhile, IGBTs, the leading midrange power semiconductor devices, are used in 1.2-kilovolt to 6.6-kilovolt applications, particularly automotive applications. “IGBT power models essentially are replacing fuel injectors in cars,” said Shawn Slusser, senior vice president of sales, marketing and distribution at Infineon. “They deliver electricity to the motor from the battery.”

IGBTs and MOSFETs are widely used, but they are also reaching their limits. That’s where wide-bandgap technologies fit in. “A bandgap refers to the energy difference in semiconductors between the top of the valence band and the bottom of the conduction band,” according to Infineon. “The larger distance allows wide-bandgap semiconductor power devices to operate at higher voltages, temperatures, and frequencies.”

Silicon-based devices have a bandgap of 1.1 eV. In comparison, SiC has a bandgap of 3.2 eV, while GaN is 3.4 eV. These two materials enable devices with higher efficiencies and smaller form factors compared to silicon, but they are also more expensive.

Each device type is different. For example, there are two SiC device types—SiC MOSFETs and diodes. SiC MOSFETs are power switching transistors. A SiC diode passes electricity in one direction and blocks it in the opposite direction.

Targeted for 600-volt to 10-kilovolt applications, SiC power devices incorporate a vertical structure. The source and gate are on the top of the device, while the drain is on the bottom. When a positive gate voltage is applied, current flows between the source and drain.

SiC is manufactured in 150mm fabs. SiC power semis have been in volume production for the last several years. “SiC is ideal for electric vehicle power conversion chips due to the high breakdown field strength, thermal conductivity, and efficiency,” said Paul Knutrud, director of marketing at Onto Innovation.

Fig. 2: How today’s power switches are categorized. Source: Infineon

Developing vertical GaN

Several vendors have been developing products based on next-generation materials and structures, such as aluminum nitride, diamond, gallium oxide, and vertical GaN.

In R&D for years, vertical GaN devices are promising. GaN, a binary III-V material, is used to produce LEDs, power switching transistors, and RF devices. GaN has 10 times the breakdown field from silicon. “The high power and high switching speeds are the major advantages of GaN,” Onto’s Knutrud said.

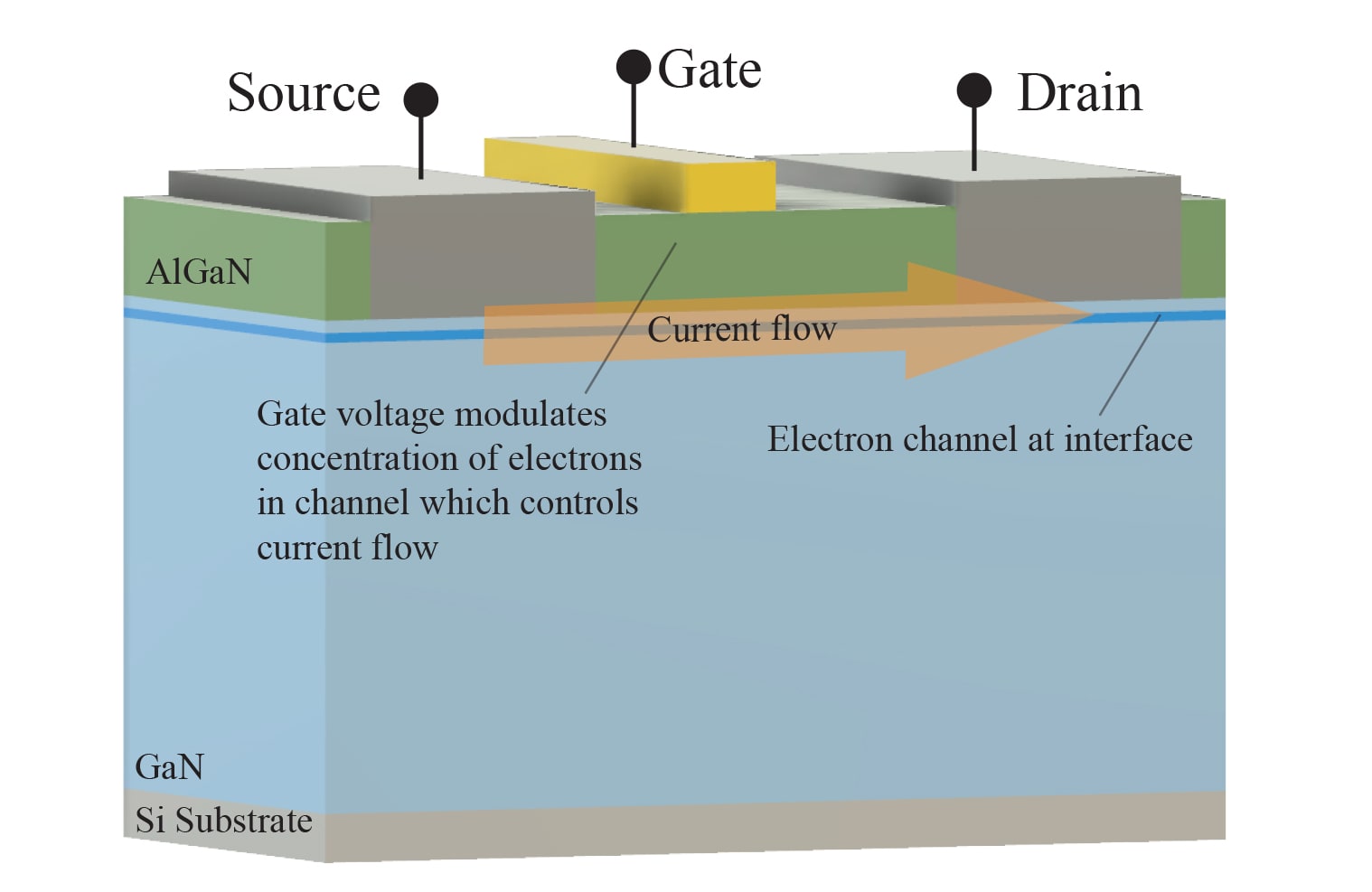

Manufactured in 150mm fabs, today’s GaN power-switching devices are based on high electron mobility transistors (HEMTs). GaN devices are lateral structures. The source, gate, and drain are on top of the structure. Lateral GaN devices are in volume production.

Some are moving GaN devices into production in 200mm fabs. “For GaN, it is the improved performance of GaN-on-silicon technologies on 200mm, and in the future even 300mm, that is underpinning the evolution of the technology,” Lam’s Haynes said.

Today’s GaN devices use silicon or SiC substrates. On top of the substrate is a thin layer of aluminum nitride (AlN), followed by a AIGaN buffer layer, and then a GaN layer. Then, a thin AIGaN barrier layer is deposited on top of the GaN, which forms a strain layer.

Today, several companies participate in the GaN power semiconductor market. Today’s lateral GaN power semis operate from 15 to 900 volts, but there are several technical challenges to operate these devices beyond those voltages.

For one thing, there is a mismatch between the dissimilar layers. “That’s really just due to the fact that when you’re growing GaN on a dissimilar substrate, you end up with a large number of defects from the mismatch between the two crystal lattices. Many defects per cm² cause premature breakdown and reliability problems,” said Rick Brown, CTO of Odyssey Semiconductor.

Work is underway to solve these problems, but lateral GaN is stuck below 1,000 volts for now. That’s where vertical GaN fits. It promises to operate at 1,200 volts and above.

Like other power semis, vertical GaN devices incorporate a source and gate on top of the device with a drain on the bottom. In addition, vertical GaN devices use a bulk GaN substrate or GaN-on-GaN. GaN substrates allow vertical-conduction GaN transistors with fewer defects, according to Odyssey.

“If you look at silicon-based high-voltage devices and silicon carbide high-voltage devices, they are all of the vertical topology. It’s the preferred topology for high-voltage devices for a number of reasons. It takes less area, which reduces the capacitance, and there’s an inherent safety factor to having the high-voltage terminal on the other side of the wafer rather than the gate terminal,” Brown said.

Fig. 3: Lateral GaN device. Source: Odyssey Semiconductor

Fig. 4: Vertical GaN device. Source: Odyssey Semiconductor

Today, Kyma, NexGen, Odyssey, Sandia and others are working on vertical GaN devices. Kyma and Odyssey are ramping up 100mm (4-inch) bulk GaN substrates.

“Vertical GaN is coming along, and we’re selling to researchers and labs,” said Jacob Leach, CTO of Kyma. “The industry has seen some challenges to make the epi. We have a different technique. We’re able to make films that are required for vertical GaN inexpensively.”

GaN substrates are ready, but it’s difficult to develop the vertical GaN devices themselves. For example, making these devices requires an ion implantation step, which injects dopants in devices. “The only reason that people haven’t used the vertical conducting topology for GaN is there hasn’t been a good way to do impurity doping. Odyssey has found a way around that,” Odyssey’s Brown said.

Odyssey is developing vertical GaN power switching devices in its own 4-inch fab. The plan is to ship devices in early 2022. Others are targeting the same time period.

“We have vertically conducting GaN devices. We have p-n junctions that we have demonstrated,” said Alex Behfar, CEO of Odyssey. “Our first product is 1,200 volts, maybe 1,200 to 1,500 volts. But our roadmap takes us all the way to 10,000 volts. We hope to contribute in a frequency and voltage range that silicon carbide cannot access, because of the capacitance and some other issues. Near term, we hope to be able to provide a device for industrial motors and solar. We hope to give electric vehicle manufacturers the opportunity to further improve the range of the vehicle. That’s by taking weight out of the system and having a better performance device. Longer term, we’re looking to enable things like on-the-go charging.”

If or when vertical GaN devices ramp up, the products won’t displace today’s lateral GaN or SiC power semis, and they will not replace silicon-based power devices. But vertical GaN devices will have a place if the technology can overcome some challenges.

“GaN vertical devices on bulk GaN substrates have created some excitement around possible next-generation power electronics, but there are a few key issues that need to resolved,” said Seanchy Chiu, senior director of technology development at UMC. “Based on physics, vertical power devices can always drive higher power output than lateral devices. But GaN bulk substrates are still expensive and the wafer size is limited to 4-inch. Pure-play foundries are manufacturing competitive power devices using 6- and 8-inch processes. Because of its vertical carrier transportation, the quality of the substrate crystal needs to be controlled and the defects minimized.”

There are other issues. “GaN substrates are more expensive than SiC substrates, and the conduction of electrons in the vertical direction in GaN is only about the same as SiC,” said Alex Lidow, chief executive of EPC, a supplier of lateral GaN power semis. “The lateral mobility of electrons is 3X better in GaN compared with SiC, but the mobility in the vertical direction is the same. In addition, SiC is three times more efficient at heat conduction. This leaves little motivation for a vertical GaN device.”

Gallium oxide semis

Meanwhile, several companies, government agencies, R&D organizations and universities are working on beta gallium oxide (β-Ga2O3), a promising ultra wide-bandgap technology that’s been in R&D for several years.

Gallium oxide, an inorganic compound, has a bandgap from 4.8 to 4.9 eV, which is 3,000 times greater than silicon, 8 times greater than SiC, and 4 times greater than GaN, according to Kyma. Gallium oxide also exhibits a high breakdown field of 8MV/cm and good electron mobility, according to Kyma.

Gallium oxide also has some drawbacks. That’s why devices based on gallium oxide are still in R&D and have not been commercialized — yet.

Still, for some time, several vendors have been selling wafers based on the technology for R&D purposes. Plus, the industry is working on semiconductor power devices based on gallium oxide, such as Schottky barrier diodes and transistors. Other applications include deep ultraviolet photodetectors.

Flosfia, Kyma, Northrop Grumman Synoptics, NCT and others are working on gallium oxide. And the U.S. Air Force and the Department of Energy, as well as several universities, are pursuing it.

Kyma has developed gallium oxide wafers at 1-inch diameters, while NCT is shipping 2-inch wafers. NCT recently has developed 4-inch gallium oxide epitaxial wafers using a melt growth method.

“Gallium oxide has made progress over the past few years, and that’s largely because you can generate high-quality substrates. So you can grow boules of gallium oxide through standard Czochralski methods or other types of liquid phase growths,” Kyma’s Leach said.

This is a crystal growth method that is widely used in the semiconductor industry. The big challenge is making power devices based on the technology.

“The challenges with gallium oxide are twofold. First, I don’t see a way for real p-type doping. You may be able to make p-type films, but you’re not going to get any hole conductivity. So it’s off the table to make bipolar devices. You can still make unipolar devices. People are working on diodes, as well as HEMT-type structures in gallium oxide. There are naysayers who say, ‘If you don’t have p-type, then forget it.’ It just means it doesn’t have as many applications in the field,” Leach said. “The second big one is thermal conductivity. Gallium oxide is quite low. That’s potentially a problem for high-power types of applications. In switching, I don’t know if that’s going to be a killer. People are doing engineering work to integrate gallium oxide with either silicon carbide or diamond to improve the thermal performance.”

Still, the industry is working on devices. “The first power device with gallium oxide will be a Schottky barrier diode (SBD). We are developing SBDs with the aim of starting sales in 2022,” said Takekazu Masui, a corporate officer and senior manager of sales at NCT.

NCT also is developing a high-voltage vertical transistor based on the technology. In NCT’s process, the company develops a gallium oxide substrate. Then, it forms a thin epitaxial layer on the wafer. The thickness of the layer can range anywhere from 5μm to 10μm.

By adopting an epitaxial layer with a low donor concentration and a thick film of 40μm as the drift layer, NCT achieved a breakdown voltage of 4.2 kV. The company plans to produce 600- to 1,200-volt gallium oxide transistors by 2025.

NCT has overcome some of the challenges with gallium oxide. “Regarding thermal conductivity, we have confirmed that a thermal resistance that can be put into practical use can be obtained by making the element thinner like other semiconductors. So we do not think that it will be a major issue,” Masui said. “NCT is developing two methods for p-type. One is to make gallium oxide p-type, and the other is to use other oxide semiconductors such as nickel oxide and copper oxide as p-type materials.”

Going forward, the company hopes to develop devices using larger substrates to reduce the cost. Reducing the defects is another goal.

Diamond, AlN technologies

For years, the industry has been looking at perhaps the ultimate power device — diamond. Diamond has a wide bandgap (5.5 eV), a high breakdown field (20MV/cm), and high thermal conductivity (24W/cm.K).

Diamond is a metastable allotrope of carbon. For electronics applications, the industry uses synthetic diamonds, which are grown via a deposition process.

Diamonds are used for industrial applications. In R&D, companies and universities for years have been working on diamond field-effect transistors, but it’s unclear if they will ever move out of the lab.

AKHAN Semiconductor has developed diamond substrates and coated glass. Device-level development is in R&D. “AKHAN has achieved 300mm diamond wafers to support the more advanced chip needs,” said Adam Khan, founder of AKHAN Semiconductor. “Diamond FETs outperform other wide bandgap materials in high power applications. While AKHAN’s doping achievements are substantial, fabricating devices around customer expectations requires substantial research and development, technical skills and time.”

There are variations of the technology. Osaka City University, for example, has demonstrated the ability to bond GaN on a diamond substrate, creating a GaN-on-diamond semiconductor technology.

Aluminum nitride (AlN) is also of interest. AlN, a compound semiconductor, has a bandgap of 6.1 eV. AlN possesses a field strength of nearly 15MV/cm, the highest of any known semiconductor material, according to HexaTech, a supplier of AlN substrates.

“AlN is suited for very short wavelength, deep-UV optoelectronic devices with a band edge down to about 205nm,” said Gregory Mills, vice president of business development at HexaTech, a subsidiary of Stanley Electric. “AlN has the highest thermal conductivity of these materials, aside from diamond, which allows for exceptional high power and high frequency device performance. AlN also has unique piezoelectric capabilities, which can be utilized in a number of sensor and RF applications.”

AlN wafers are available from several vendors at 1- and 2-inch diameters. AlN is already gaining traction. Stanley Electric and others are using AlN wafers to produce ultraviolet LEDs (UV LEDs). These specialized LEDs are used for disinfection and purification applications. When microorganisms are exposed to wavelengths between 200nm and 280nm, the UV-C energy destroys the pathogens, according to HexaTech.

“Single-crystal AlN substrate-based devices are transitioning as we speak from R&D to commercial products, depending on the application space,” Mills said. “The first of these is deep-UV optoelectronics, specifically UV-C LEDs, which are surging in demand due to their ability to sterilize and deactivate pathogens, including the SARS-CoV-2 virus.”

Years ago, HexaTech received an award from the U.S. Department of Energy to develop AlN power semiconductors. There are several challenges here. First, the substrates are expensive. “I don’t know that aluminum nitride makes a whole lot of sense here, because it has problems with both n-type and p-type doping,” Kyma’s Leach said.

Conclusion

Still, devices based on various next-generation materials and structure are making progress. They have some impressive attributes. But they must overcome a host of issues.

“That means there will be a large capital investment needed to get them into volume production,” EPC’s Lidow said. “The added benefits and the size of the available markets will need to justify the large capital investment.”

Related Stories

The Silicon Carbide Race Begins

As SiC moves to higher voltages, BEV users get faster charging, extended range, and lower system costs

Improving Reliability For GaN And SiC

Power Semi Wars Begin

Leave a Reply